Happy Sunday Everyone:

Kim suggested this might be the most boring Sunday Thoughts ever. If you’re not in sales, I’d probably agree. If you are, it’s worth consideration.

Our division had a great business planning session with myself and my great friend, JJ Mazzo last week. One of the top LO’s called it the best 30-minute planning session he’d heard in 20 years. I’ll give 90% of the credit to JJ, I just asked questions. One of the primary topics we discussed was understanding your numbers. How many leads, how credit pulls, pre-approvals, locks, funding. It starts to give you a clear picture on where you need help. Some people need more leads, some people need better conversion ratios, most of us need both.

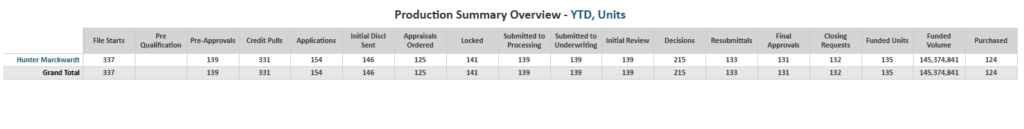

Our leadership team decided we’re going to provide every loan officer in our division with their numbers to help them ask/answer the same questions. More leads? better conversions? both? This is exactly what we will be sending out to each loan officer: The only thing we aren’t able to track is the exact number of leads each loan officer brought it. My own numbers aren’t a brag. I have a lot of volume because my average loan amount is high, folks in other parts of the country typically have more units, with lower loan amounts. I’d like to have both higher units, and larger loan amounts but knowing my numbers is key:

For people at CCM: here are the following definitions:

File Started – New Encompass File

Pre-Approval- Fast track approval (full underwrite ahead of contract)

Credit Pull – Credit pulled on loan in Encompass

Application- RESPA triggered

I also know that I have 592 leads YTD, way less than what I want. JJ suggested we should be able to do a credit pull on 70% of the leads we speak with, I’m currently at 56% (331/592). Think about it like this, based on current numbers, 40% of my credit pulls end up closing (135 closing/331 credit pulls). So, if I can my get credit pulls up to 70%, that would be 414 credit pulls instead of 331. If I close 40% of my credit pulls, that would mean I close 165 loans instead of 135, which at an average loan amount of $1,076,000, this would take my volume up from $145,374,841, to $177,654,841. All you loan officers can do the math on what that does to income.

I geek out on this stuff. Now one of my primary goals for 2025 is to get my credit pulls up to 70%. I also know I have a 24% conversion ratio from lead to close (135 closing/592 leads). If we focus entirely on our execution to get that to 30%, this would take us from 135 closings, to a 177 closings (30% of 592 leads). We start talking about how do we do that? Quality of leads, qualify of business partners, our process, our client service, etc… You start to get granular about how you solve to be better and then track it monthly to see if you’re making progress.

Net net-if you’re part of our division, this is coming to you anyway, if you’re not, you need to do a review of what these numbers looked like for you in 2024 and what you want them to look like in 2025. I feel like I’m on top of my business because I understand my numbers and where I need to allocate my time to increase conversion ratios.

Assuming you work 40 hours a week, that’s 2080 hours in a year, we owe it to ourselves to allocate at least 2-5 hours working on our business for 2025.